Following the approval of Pfizer’s COVID-19 vaccine, we started 2021 full of hope. With vaccines in the supply-chain, the idea was to get shots in people’s arms as quickly as possible, curb the pandemic and get life back to normal. That was the plan then.

12 months on, roughly 9 billion doses have been administered. In the United States, three vaccines—Pfizer-BioNTech, Moderna and Johnson & Johnson — are widely available. Elsewhere, about two dozen other vaccines have also been approved. In many higher-income countries, booster shots have already started to be administered.

But 2021 also gave us a wealth of knowledge about vaccines’ capabilities. With the emergence of aggressive unpredictable variants, inequitable distribution, hesitancy, and the natural course of waning effectiveness, we now know there still remains much work to do to bring this pandemic to an end. As if to hammer home the point, the detection of the Omicron variant in late November brought home the uncertainty of the pandemic’s trajectory.

So here are some of the key lessons we’ve learned in 2021 about COVID-19 vaccines.

COVID-19 vaccines work, even against emerging variants

Many COVID-19 vaccines proved effective over the last year, particularly at preventing severe disease and death. That’s true even with the emergence of more transmissible coronavirus variants.

In January, during a bleak winter surge that saw average daily cases in the United States peak at nearly a quarter a million, the vaccination rollout here began in earnest. Soon after, case numbers began a steep decline.

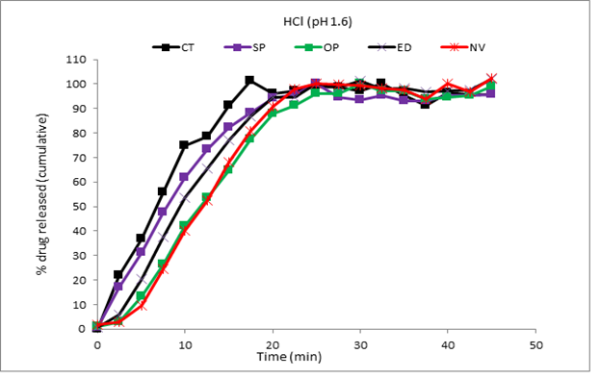

Over the summer, though, more reports of coronavirus infections in vaccinated people began to pop up. It was this time that we learnt protection against infection becomes less robust several months following vaccination for Pfizer’s or Moderna’s mRNA vaccines. But the vaccines’ original target — preventing hospitalization — remained stable, with an efficacy of between 80 percent to 95 percent.

Studies also showed that a single dose of Johnson & Johnson’s vaccine was less effective at preventing symptoms or keeping people out of the hospital than the mRNA jabs. The company claims, though, that there’s not yet evidence that the protection wanes. But even if that protection is not weakening, some real-world data hint that this vaccine may not be as effective as clinical trials had suggested.

It is against this evidence (of waning protection) that governments ultimately mooted the idea of COVID-19 booster vaccines for adults.

Concern about declining immunity came to a head amid the spread of highly contagious variants, including Alpha, first identified in the United Kingdom in September 2020, and Delta, first detected in India in October 2020. Currently, Delta is the dominant variant globally.

The good news is that vaccinated people aren’t unarmed against these mutated variants. Clinical data has demonstrated that vaccines trigger antibodies that are still able to attack Alpha and Delta, albeit with slightly less intensity than for the original Wuhan variant that emerged out of China two years ago. Antibodies also still recognize more immune-evasive variants such as beta, first identified in South Africa in May 2020, and gamma, identified in Brazil in November 2020. Although protection against infection dips against many of these variants, vaccinated people remain much less likely to be hospitalized compared with unvaccinated people.

Experts will continue to track how well the vaccines are doing, especially as new variants, like Omicron, emerge. In late November, the World Health Organization designated the omicron variant as the latest variant of concern after researchers in South Africa, and warned that it carries several worrisome mutations. Preliminary studies suggest that Omicron can reinfect people who have already recovered from an infection. The variant is at least as transmissible as Delta. We now know that Omicron may affect vaccine effectiveness. Pfizer-BioNTech’s two-dose vaccine, for instance, is about 30 percent effective at preventing symptoms from Omicron infections while a booster could increase effectiveness back up to more than 70 percent, according to estimates from Public Health England.

Vaccines are safe, with few serious side effects

With close to nine billion of doses administered around the world as of year-end, the shots have proved not only effective, but also remarkably safe, with few serious side effects.

Commonly reported side effects include pain, redness or swelling at the spot of the shot, muscle aches, fatigue, fever, chills or a headache. These symptoms usually last only a day or two.

But more rare and serious side effects have also been reported. However, none are unique to these vaccines. In deed other vaccines — and infectious diseases, including COVID-19 — also cause these adverse effects.

One example is myocarditis and pericarditis. Current estimates are a bit fluid since existing studies have different populations and other variables. However, two large studies in Israel estimated that the risk of myocarditis after an mRNA vaccine to about 4 of every 100,000 males and 0.23 to 0.46 of every 100,000 females. Researchers also reported in October in the New England Journal of Medicine. Yet members of Kaiser Permanente Southern California who had gotten mRNA vaccines developed myocarditis at a much lower rate: 5.8 cases for every 1 million second doses given, researchers reported, also in October, in JAMA Internal Medicine.

What all the studies have in common is that young males in their teens and 20s are at highest risk of developing the side effect, and that risk is highest after the second vaccine dose. But it’s still fairly rare, topping out at about 15 cases for every 100,000 vaccinated males ages 16 to 19, according to the larger of the two Israeli studies. Males in that age group are also at the highest risk of getting myocarditis and pericarditis from any cause, including from COVID-19.

Components of the mRNA vaccines may also cause allergic reactions, including potentially life-threatening anaphylaxis. The U.S. Centers for Disease Control and Prevention calculated that anaphylaxis happens at a rate of about 0.025 to 0.047 cases for every 10,000 vaccine doses given.

But a study of almost 65,000 health care system employees in Massachusetts suggests the rate may be as high as 2.47 per 10,000 vaccinations, researchers reported in March in JAMA. Still, that rate is low, and people with previous histories of anaphylaxis have gotten the shots without problem. Even people who developed anaphylaxis after a first shot were able to get fully vaccinated if the second dose was broken down into smaller doses.

The only side effect of the COVID-19 vaccines not seen with other vaccines is a rare combination of blood clots accompanied by low numbers of blood-clotting platelets. Called thrombosis with thrombocytopenia syndrome, or TTS, it’s most common among women younger than 50 who got the Johnson & Johnson vaccine or a similar vaccine made by AstraZeneca that’s used around the world.

About 5 to 6 TTS cases were reported for every 1 million doses of the J&J vaccine, the company reported to the U.S. Food and Drug Administration. The clots may result from antibodies triggering a person’s platelets to form clots. Such antibodies also cause blood clots in COVID-19 patients, and the risk of developing strokes or clots from the disease is much higher than with the vaccine. In one study, 42.8 of every 1 million COVID-19 patients developed one type of blood clot in the brain, and 392.3 per 1 million developed a type of abdominal blood clot, researchers reported in EClinicalMedicine in September.

Getting everyone vaccinated is not easy

The quest to vaccinate as many people as quickly as possible last year faced two main challenges: getting the vaccine to people and convincing them to take it. Strategies employed so far — incentives, mandates and making shots accessible — have had varying levels of success.

“It’s an incredibly ambitious goal to try to get the large majority of the country and the globe vaccinated in a very short time period with a brand-new vaccine,” says psychologist Gretchen Chapman of Carnegie Mellon University in Pittsburgh, who researches vaccine acceptance. Usually “it takes a number of years before you get that kind of coverage.”

Globally, that’s sure to be the case due to a lack of access to vaccines, particularly in middle- and lower-income countries. The World Health Organization set a goal to have 40 percent of people in all countries vaccinated by year’s end. But dozens of countries, mostly in Africa and parts of Asia, are likely to fall far short of that goal.

In contrast, the United States and other wealthy countries got their hands on more than enough doses. Here, the push to vaccinate started out with a scramble to reserve scarce appointments for a free shot at limited vaccination sites. But by late spring, eligible people could pop into their pharmacy or grocery store. Some workplaces offered vaccines on-site. For underserved communities that may have a harder time accessing such vaccines, more targeted approaches where shots are delivered by trusted sources at community events proved they could boost vaccination numbers.

Simply making the shot easy to get has driven much of the progress made so far, Chapman says. But getting people who are less enthusiastic has proved more challenging. Many governments and companies have tried to prod people, initially with incentives, later with mandates.

Free doughnuts, direct cash payments and entry into million-dollar lottery jackpots were among the many perks rolled out. Before the pandemic, such incentives had been shown to prompt some people to get vaccines, says Harsha Thirumurthy, a behavioral economist at the University of Pennsylvania. This time, those incentives made little difference nationwide, Thirumurthy and his colleagues reported in September in a preliminary study posted to SSRN, a social sciences preprint website. “It’s possible they moved the needle 1 or 2 percentage points, but we’ve ruled out that they had a large effect,” he says. Some studies of incentives offered by individual states have found a marginal benefit.

“People who are worried about side effects or safety are going to be more difficult to reach,” says Melanie Kornides, an epidemiologist at the University of Pennsylvania. And with vaccination status tangled up in personal identity, “you’re just not going to influence lots of people with a mass communication campaign right now; it’s really about individual conversations,” she says, preferably with someone trusted.

As COVID-19 mandates went into effect in the fall, news headlines often focused on protests and refusals. Yet early anecdotal evidence suggests some mandates have helped. For instance, after New York City public schools announced a vaccine requirement in late August for its roughly 150,000 employees, nearly 96 percent had received at least one shot by early November. Still, about 8,000 employees opted not to get vaccinated and were placed on unpaid leave, the New York Times reported.

Many people remain vehemently opposed to the vaccines, in part because of rampant misinformation that can spread quickly online. Whether more mandates, from the government or private companies, and targeted outreach will convince them remains to be seen. — Jonathan Lambert

Vaccines can’t single-handedly end the pandemic

One year in, it’s clear that vaccination is one of the best tools we have to control COVID-19. But it’s also clear vaccines alone can’t end the pandemic.

While the jabs do a pretty good job preventing infections, that protection wanes over time. Still, the vaccines have “worked spectacularly well” at protecting most people from severe disease. As more people around the world get vaccinated, fewer people die, even if they do fall ill with COVID-19.

“We have to make a distinction between the superficial infections you can get — [like a] runny nose — versus the lower respiratory tract stuff that can kill you,” such as inflammation in the lungs that causes low oxygen levels, Luning Prak says. Preventing severe disease is the fundamental target that most vaccines, including the flu shot, hit, she notes. Stopping infection entirely “was never a realistic goal.”

Because vaccines aren’t an impenetrable barrier against the virus, we’ll still need to rely on other tactics to help control spread amid the pandemic. “Vaccines are not the sole tool in our toolbox,” says Saad Omer, an epidemiologist at Yale University. “They should be used with other things,” such as masks to help block exposure and COVID-19 tests to help people know when they should stay home.

For now, it’s crucial to have such layered protection, Omer says. “But in the long run, I think vaccines provide a way to get back to at least a new normal.” With vaccines, people can gather at school, concerts or weddings with less fear of a large outbreak.

Eventually the pandemic will end, though when is still anyone’s guess. But the end certainly won’t mean that COVID-19 has disappeared.

Many experts agree that the coronavirus will most likely remain with us for the foreseeable future, sparking outbreaks in places where there are pockets of susceptible people. Susceptibility can come in many forms: Young children who have never encountered the virus before and can’t yet get vaccinated, people who choose not to get the vaccine and people whose immunity has waned after an infection or vaccination. Or the virus may evolve in ways that help it evade the immune system.

The pandemic’s end may still feel out of reach, with the high hopes from the beginning of 2021 a distant memory. Still, hints of normalcy have returned: Kids are back in school, restaurants and stores are open and people are traveling more.