In the run-up to Christmas, there was considerable anxiety about shortages of all sorts of goods, from toys, food, and medical supplies. These were down to supply chain pinch points, exacerbated by the global pandemic, and multiple other factors that all came to a head in Q3 and 4.

As Europe settles into 2022, pharmaceutical manufacturers are a vertical that face specific challenges. We polled representatives from across the sector, from CROs, CDMOs, generic and R&D intensive manufacturing companies. Here are the highlights of what we found out.

Supply chains

The Covid-19 pandemic has affected every part of the manufacturing value chain, from raw material to end customers. Companies are reporting continued disruptions in global logistics which are impacting the flow of raw materials and goods due to congestion and shutdowns at major global ports and airports, largely in China, South Korea, and the US.

As the year progresses, these disruptions will lessen, and access to sea and airfreight will improve back to pre-pandemic levels, but companies can still expect to see higher input prices (as excessive freight costs are passed on), and longer lead times because of the length it takes to clear logjams in the supply chain.

Sustainability goals

COP26 has provided new impetus for action on sustainability, and many companies have committed to ambitious goals. Turning these commitments into tangible goals requires companies to work with suppliers that adhere to social and environmental standards. However, firms face special challenges governing lower-tier suppliers (lower down the value chain) due to absence of direct contractual relationships. Often, lower-tier suppliers are the least equipped to handle sustainability requirements.

Skilled labour shortages

Having a qualified workforce is essential to ensuring the high levels of quality required in the pharmaceutical industry are met. However, many companies are reporting shortages, both for white and blue collared workers, in terms of both skills and numbers. Uncertainties over the last years have exacerbated shortages but there are several other non-COVID-19 related factors at play, including changes in demographics.

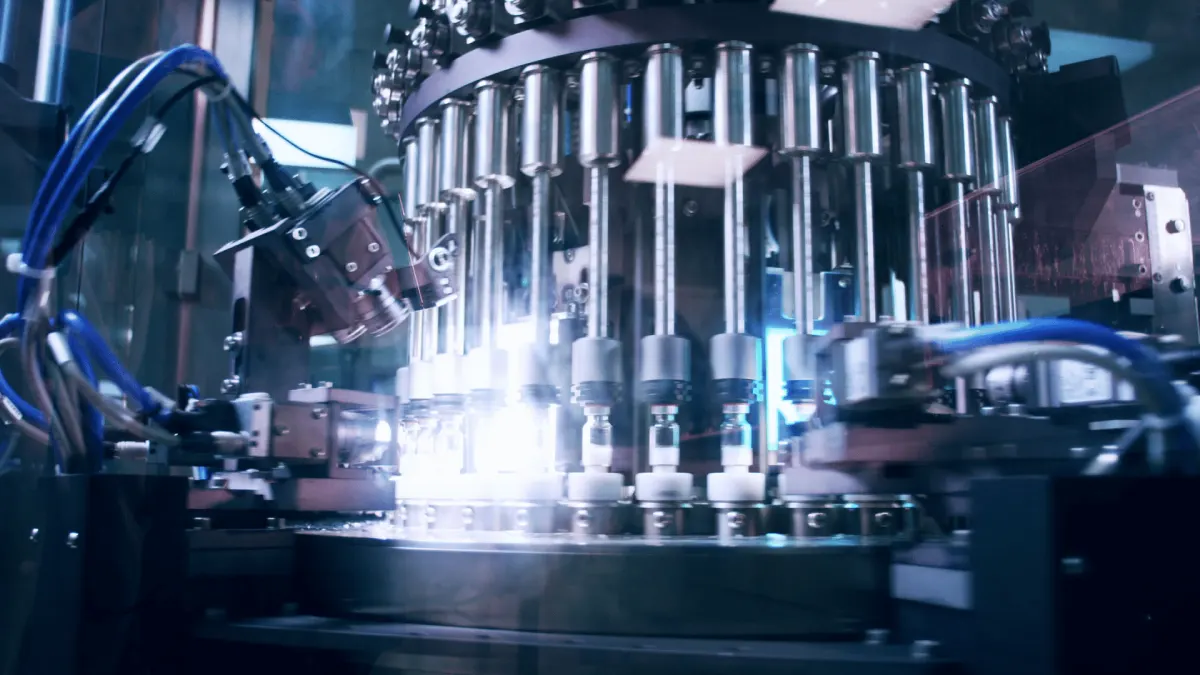

Manufacturing flexibility

As the past two years have demonstrated, resilience is predicated on agility and adaptability rather than impregnability. In order to rapidly respond to evolving market dynamics, pharmaceutical manufacturers need to transform their manufacturing models into those that are flexible, using production methods designed to easily adapt to changes in the type and quantity of the product being manufactured. However, while desired, flexibility is not that easy to pull off in a highly regimented sector that is pharma. Changes to decades-old and established methodologies require fresh and expensive regulatory scrutiny. Importantly, new, and specialised machinery need to be purchased and installed to allow for this level of customization, and not every firm has access to finance or the manpower to achieve this transformation within the needed timelines.

Final thoughts

The pandemic has brought to the fore the vulnerabilities of European pharmaceutical market. Issues such as supply chain are transient whereas changing demographics, mainly from aging and retiring workers, as well as border and immigration controls, are structural. Going forward, it will be necessary to formulate a suitable policy mix to address these challenges.

References

- GlobalData, 2021. COVID-19: Contract Pharmaceutical Development and Manufacturing Relationships. [online]. Available at: https://store.globaldata.com/report/gdps0038mar…

- CPhI, 2021. Pharma Trends 2022. [online] CPhI, pp.6-7, 16. Available at https://www.cphi-online.com/cphi-pharma-trends-2022-report…[Accessed 10 January 2022].