Vinod Kumar

PharmaCentral.com Guest Writers

Amid calls for developed nations to do more, US President Joe Biden recently announced that his administration will be availing 500 million doses of the BioNTech-Pfizer COVID-19 vaccine to 92 developing nations. The announcement was much welcome news, coming at a time when many low income countries are in a grip of rising coronavirus infections.

Low income countries are especially vulnerable to the pandemic due to, among other factors, their underdeveloped health systems and lack of local vaccine manufacturing capacity. If you consider that as of June 2021, of the 2 billion COVID-19 vaccine doses administered, only 0.3% has reached low-income countries, principally in Africa, where vaccination rates are as low as 1%. At this rate, it will take several years to achieve vaccine coverage that’s similar to that of wealthier countries.

So as much as Biden’s announcement is much welcomed, plenty of people are calling for a more sustainable solution. An official as COVAX, a UN scheme distributing jabs to poor countries, was recently quoted in the main press questioning whether the US pledge will have any impact at all. What is needed is expansion of vaccine manufacturing capabilities regionally, in Africa, Asia and Latin America, to produce generic vaccines quickly to avert needless deaths.

Problem is vaccine manufacturing is complex, and may not necessarily be cost-effective. It requires huge resources, expertise and time. In Africa, for instance, only Senegal is WHO prequalified to make vaccines. So for most of the continent, the option to repurpose existing facilities for local production does not exist.

The question on many peoples’ minds then is, what option do low income countries have? Is local vaccine manufacturing viable? Admittedly, this is vast topic and my is to provide an overview rather than a deep dive analysis.

What it takes to manufacture vaccines

In short, a lot! First, here are the headline figures: estimates very but generally between US$ 200 M to 700 M to develop a vaccine from concept to market, and another USUS$D 50 M – 130 M to construct, equip and commission the manufacturing facility. Development time and facility construction take at least 3 years, plus a further 1 year lead time to get the vaccine to market after commissioning.

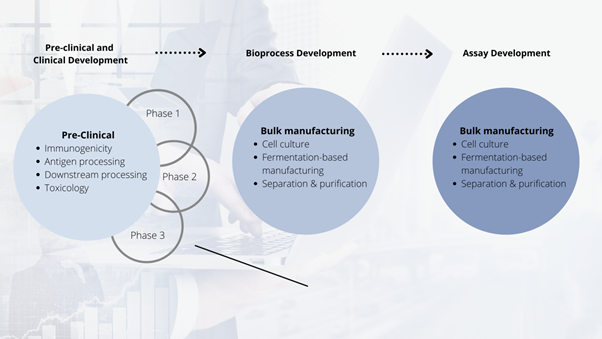

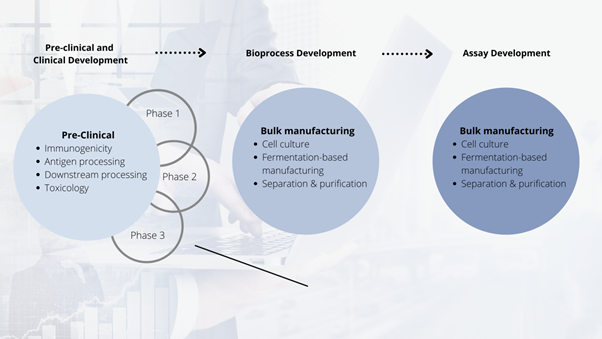

Conceptual vaccine development process (adapted from multiple sources, including Robinson, 2016)

Money aside and perhaps most important, many things must perfectly align. Robust and well defined methods and processes have to be developed, testing and monitoring regimes established, and above all, a company-wide commitment to comply with internal and external standards and regulations established. It is why vaccinologists say “the vaccine is the process” referring to the sum total of different steps that define success or failure.

So while not impossible (COVID-19 has taught us what science can achieve), it is no small feat, particularly for a country with no prior manufacturing experience.

Basics of vaccine manufacture

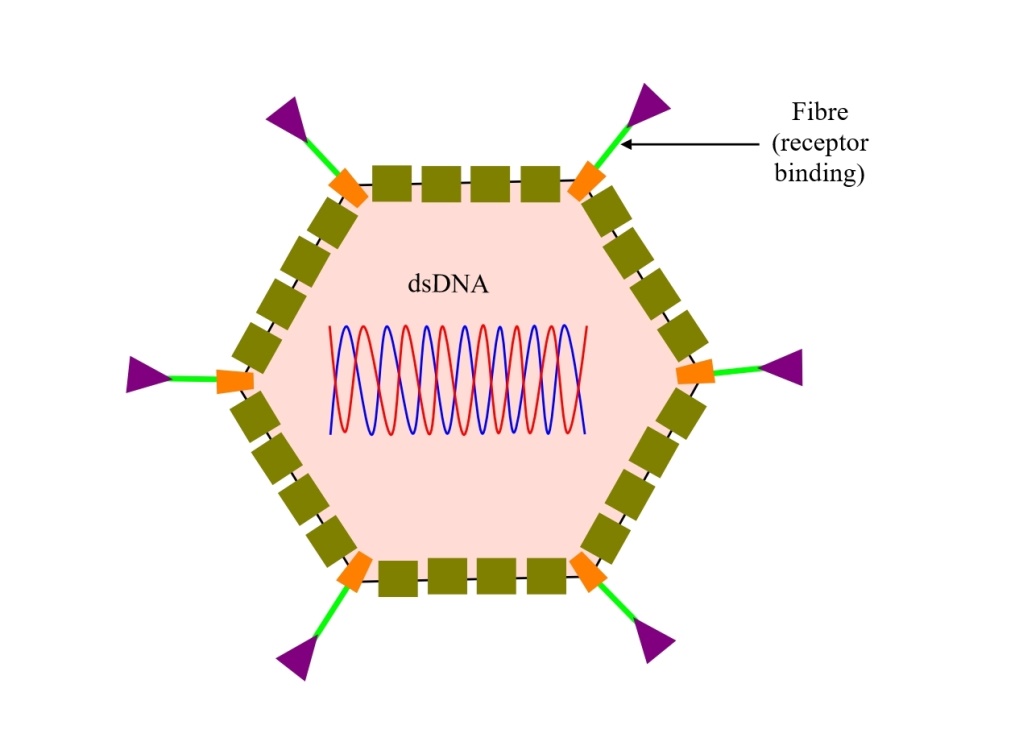

There is currently no standard vaccine manufacturing process. Processes differ by vaccine platform and at times, from manufacturer to manufacturer. However, for most vaccines, the process involves some sort of cell culture/fermentation, isolation and purification of active substances, formulation, fill-and-finish, and packaging. The entire process, from start to finish can take anywhere between 7 days to several months.

If we take a biological-based vaccine, we can categorise the different manufacturing processes into three main steps: in the first step (upstream), the cell culture is developed, standardised and induced to produce the active substance (e.g protein or virus). In the second step (downstream), the cell culture is harvested, purified and filtered to produce the pure active substance. In the last step (fill-and-finish), the active is formulated (excipients and stabilisers added) into a vaccine, filled into vials, inspected and packaged ready to ship to the clinic.

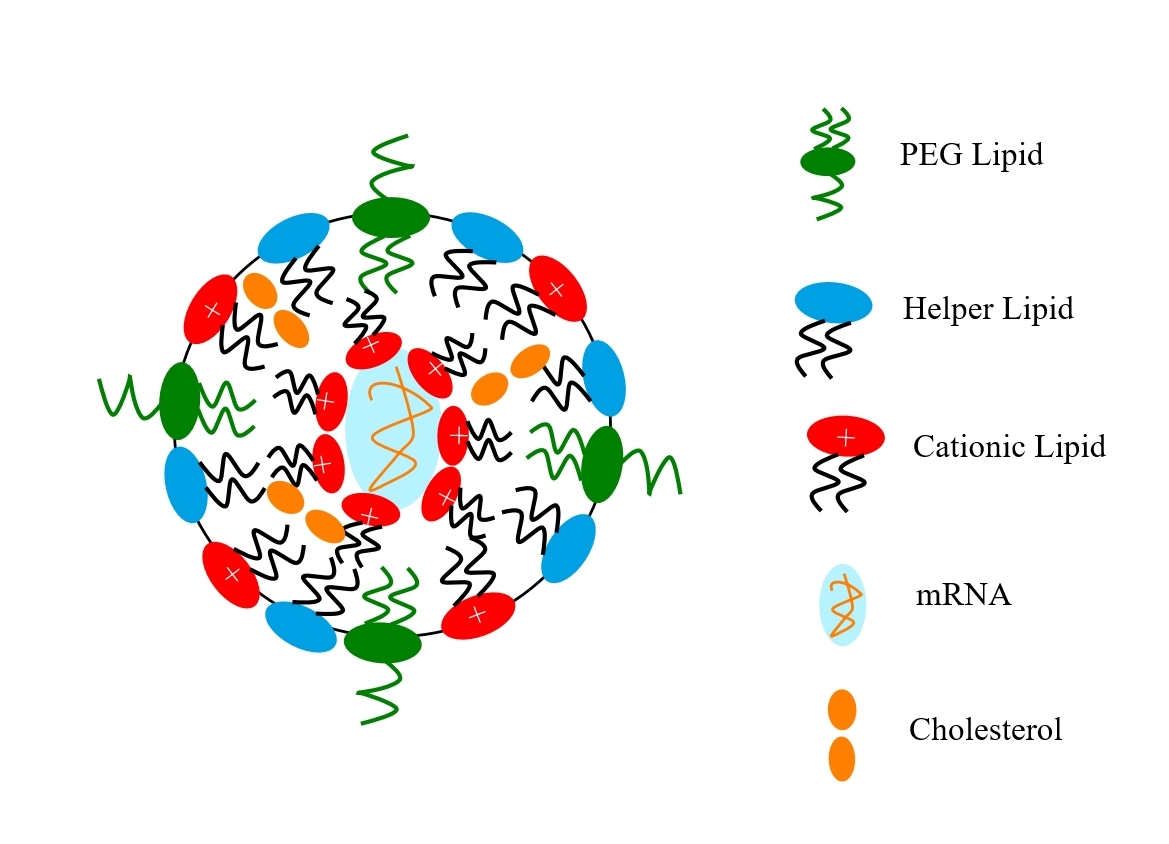

The process for the manufacture of mRNA vaccines is less complex because it is mainly synthetic. It starts with a plasmid DNA for the mRNA being produced via fermentation. Using an enzyme-catalysed in-vitro transcription process, the mRNA that codes for the spike protein is produced. The new mRNA is chemically modified (capping and stabilisation) to render it biologically active. It is purified and then formulated into lipid nanoparticles in a microfluidic process. Once formulated, it undergoes fill and finish, quality control and packaging in the same way as other vaccines.

What potential obstacles would a new manufacturer face?

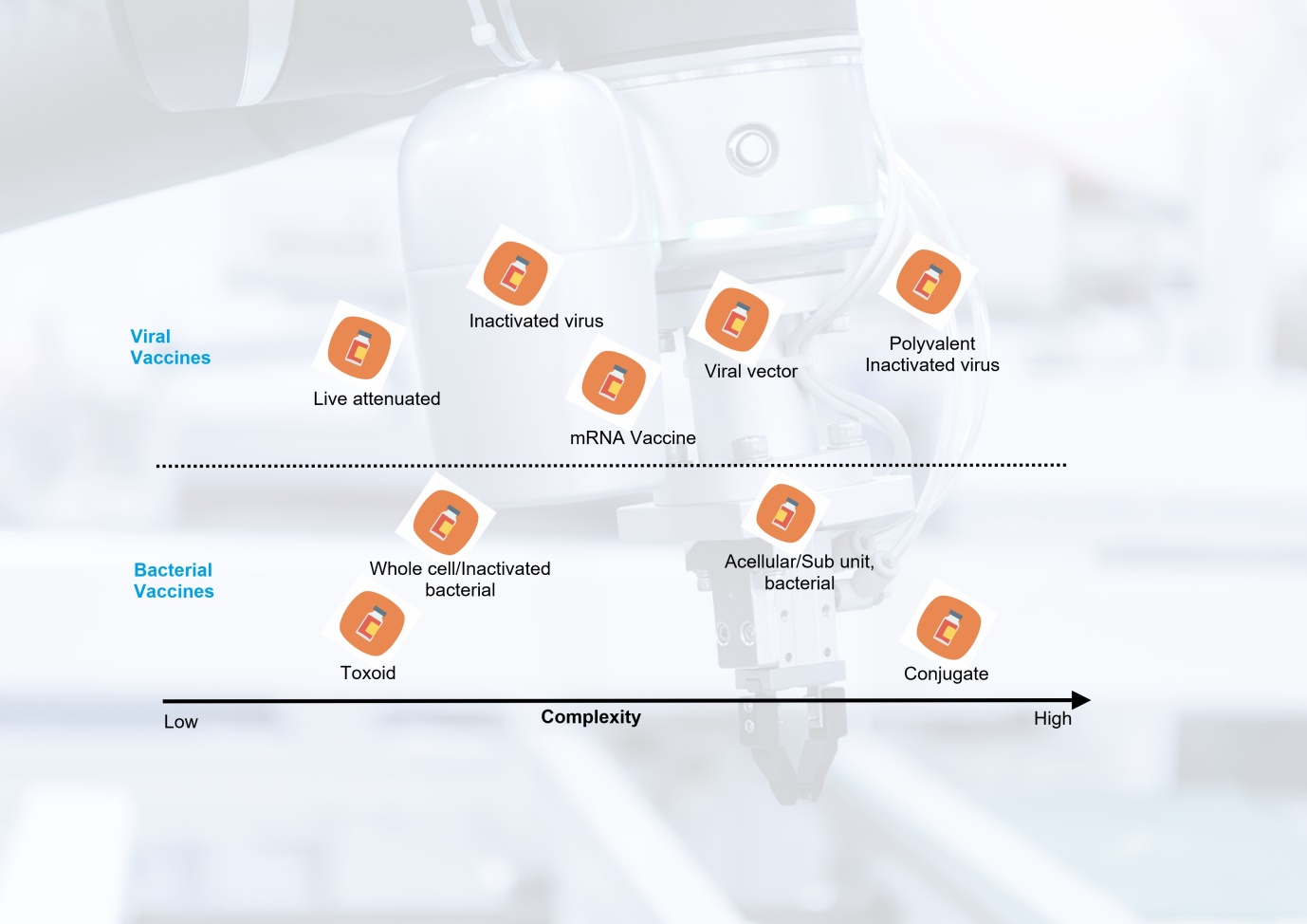

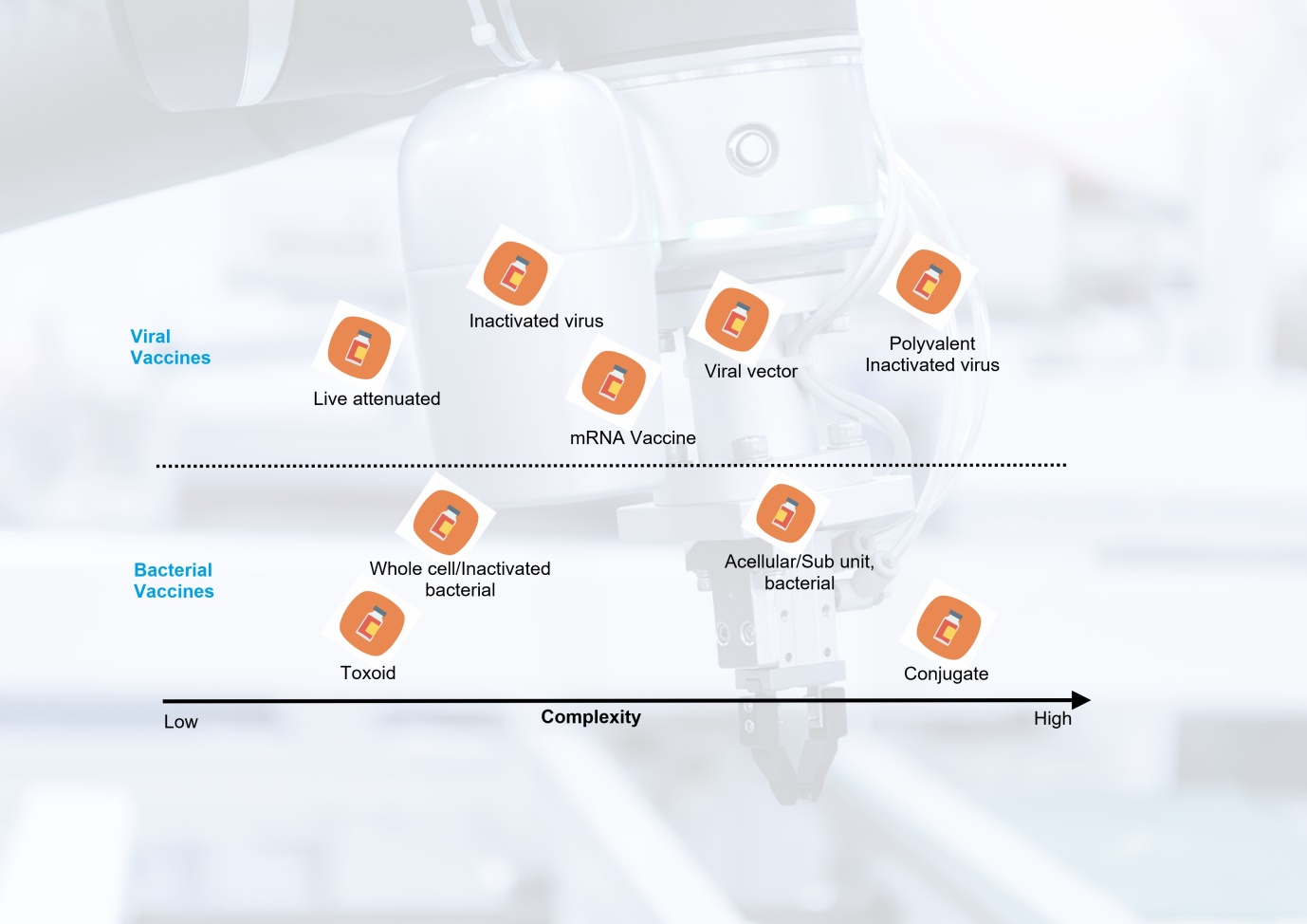

Vaccines are not created equal, but you knew that already. The range and relative production complexity of several vaccine types is shown below. At one end is the live attenuated oral polio vaccine with significantly lower complexity and production costs while at the other end is the pneumococcal conjugate vaccine.

Vaccine types and comparative production complexity

Vaccine types and comparative production complexity

Notwithstanding, there are common equipment or equipment types shared across platforms such as bio reactors, filtration and purification, filling and lyophilisation equipment, although the sequence of operations and the specific cycles for each product may vary. In most cases, each product has its own dedicated facility requirements as well as skillset.

Here below are some of the most important considerations:

1. Process development and maintenance

Introducing new or changes to facilities, manufacturing equipment, processes or raw materials triggers regulatory examination to confirm that processes are robust enough to ensure the vaccine is equivalent to the product produced in the original clinical or reference batches. Erecting a new facility and the accompanying processes will be a significant undertaking because the facility and processes define the product, but also all stakeholders have to have visibility into how the manufacturing process, quality control, specifications as well as all the support utilities will pan out at commercial scale quite early one.

2. Raw materials and consumables

Many of the raw materials and consumables used in vaccine manufacture are highly specialized in nature, with a few being produced by biological production methods. For these reasons, there are only so many suppliers available and the supply situation is subject to shortages or long lead times, not helped that we are currently in the middle of a pandemic and pressure on supplies is heightened. When materials are in short supply they tend to be expensive due to usual supply and demand dynamics. One option is to qualify multiple suppliers especially for critical materials, but this means extra work auditing suppliers and qualifying materials, which likely increases costs of goods.

3. Regulatory affairs and commercialization

Vaccine regulatory requirements and steps for obtaining marketing approval are well documented. They are also broadly similar across the world although the exact compliance requirements differ from country to country. Also, some vaccine products may be made only for specific countries based on their requirements, and for these, regulatory agencies may have their own flexibilities built into review and inspection regimes.

Whatever the local arrangements, manufacturers are expected to comply with all requirements applicable for the relevant regulatory agencies (including those the company wishes to sell its vaccine). These requirements include adherence to good manufacturing practices as well as routine monitoring of adverse event data, and annual reporting of specific manufacturing information (e.g., data trends, change management, stability review, CAPA, etc).

In addition, a manufacturing facility will be routinely subjected to external audits and inspections to assess compliance with GMP, facility maintenance, manufacturing and quality systems, and performance of the process. For the uninitiated, this is a lot to take.

If the new company wishes to sell their vaccine to highly lucrative WHO and UNICEF projects (essential for long-term business sustainability), then compliance with WHO’s Pre-Qualification (PQ) is mandatory. A PQ assessment process can take up to a year to complete excluding any additional required to respond to queries.

But even before a vaccine can be considered for PQ, the sponsoring regulatory agency must be first qualified as “functional” by WHO. WHO’s standards for “functionality” are immense and currently, there are only two African states with an national regulatory agency adjudged as “functional” for vaccines sponsoring purposes.

Manufacturing costs

The costs of manufacturing a vaccine are influenced by several factors. Here, I will focus on facilities, equipment, raw materials, process development and labour but clinical development and financing costs. Facilities and maintenance, raw materials, production, personnel and compliance comprise direct costs, while indirect costs include the creation and implementation of quality systems, operations planning, inventory and distribution, and sales, marketing and management. In the table below, we list some of the important costs and how they could be reduced.

Major vaccine production cost drivers and ways to reduce them

| Major Cost Driver |

Impact on overall costs |

Cost range |

Examples of ways production costs can be lowered |

| Product Development

R & D facilities

R & D staff

Research costs |

High

(High fixed costs) |

>500 M US$ |

Copy originator process where possible

Perform technology transfer

Use immunological surrogates in lieu of efficacy studies

Purchase antigens and execute form/fill prior to full end-to-end manufacturing |

| Facilities and Equipment

Land

Buildings

Equipment

Ongoing maintenance costs |

High

(high fixed costs) |

50 to 130M US$ |

Design for very high facility utilization

Repurpose existing facilities

Use multi-dose vials

Use single-use disposable systems

Consider blow-fill-seal technology

Use closed systems to reduce classified production space |

| Direct Labour

Wages & benefits |

Low |

Comparatively lower in developing counties (typically 25 – 50%) |

Increase single-use production technologies

Develop capacity progressively |

| Overhead

Management, quality systems, IT systems |

High |

Up to 50% cost of raw materials and labour |

Streamlined quality systems.

Management with broad expertise |

| Licensing/Regulatory and commercialization |

High |

100k to 1M US$

For staff and consulting costs, WHO PQ, Site audits & evaluation fees |

Pursue WHO PQ only if needed

Request royalty reductions or waivers

Accelerate approval by seeking NRA or WHO priority review for emergency use |

Facilities and equipment maintenance

Constructing and maintaining a vaccine manufacturing facility is a major cost for a vaccine manufacturer. A green-field, purpose-built vaccine manufacturing facility in North America can easily cost 50 – 750 M US$ per antigen, depending on the complexity of design, automation, segregation, utilities, and contamination controls. Based on current rates, GMP space cost from 6k US$/m2; while non-GMP space costs 3k US$/m2. The cost of clean rooms and containment rooms is higher. It can take up to 7 years to design, build, validate, and commission a manufacturing facility. These estimates are for developed countries, so actual facilities cost may be lower in developing countries, although not by much since many materials and fixtures need to be imported and some key personnel hired from other countries as expatriates.

Process development

The focus here is on the steps used to develop and validate the manufacturing process leading to a licensed product. The key steps for process and analytical development and associated time frames during clinical development are outlined in the table below.

Key vaccine development stages and process/system expectations

| Phase |

Goal |

Remark |

| Exploratory & Pre-clinical |

Immunogenicity & safety assessment of target antigen or cell in cell culture or animal disease model |

Small scale. Attention paid to method of manufacturing as it impacts nature of vaccine. Process development not critical at this stage |

| Clinical Trial Authorization Application |

Obtain approval to conduct human clinical studies |

An outline critical manufacturing and analytical methods for producing vaccine required. Also, quality, purity and stability required to be demonstrated |

| Phase I Vaccine Trials |

Safety assessment of candidate vaccine. Type and extent of immune response elicited |

GMP manufacture of all clinical trial material. Process development ideally optimised by this stage although this can be deferred |

| Phase 2 Vaccine Trials |

Assessment of safety, immunogenicity, dose response, schedule of immunizations |

All major process changes completed and qualified. Anticipated cost of goods determined |

| Phase 3 Vaccine Trials |

Assessment of candidate in target population for safety & adverse events. Efficacy is estimated. manufacturing consistency confirmed |

Processes finalized and validated. Analytical tests for release are completed and validated. Costs of goods are confirmed as any changes need to be re-validated and may require additional clinical testing |

| Approval & Licensure |

Biological Product Application approval |

Completed full review and details of manufacturing methods and analytical methods; shelf-life stability studies; process validation, facility validation, release testing validation; launch lots prepared and released. Regulatory agency inspection of all manufacturing and release facilities and manufacturing and quality systems documentation |

Costs of process and analytical development, manufacturing, and documentation are highly dependent on vaccine type, technical complexity, disease target and regulatory body. Some independent analysists have calculated that the Chemistry, Manufacturing and Controls (CMC) development aspects for a vaccine range from 5 M US$ to 50 M US$ and require between 50 and 100 person-years in human resources. If a manufacturer from a developing country chooses to licence technology or partner with an established manufacturer, this can reduce costs and development time significantly.

Labour costs

Having a motivated, technically competent and committed workforce is a major requirement for any vaccine manufacturer, irrespective of where there are domiciled. Companies also need to be able to hire, train, and develop their workforce, a challenge even for highly experienced manufacturers.

For many reasons we don’t have time and space to go into, there is a shortage of personnel with the requisite skills and expertise needed by the vaccine industry. The deep scientific knowledge required to support such an endeavour takes years to acquire, so developing countries are at a disadvantage when it comes to establishing and sustaining local vaccine manufacturing capacity.

Countries such as China and India have large populations to draw from, not mentioning the huge financial resources, which have enabled them to build relatively sound technical and scientific foundations within a single generation. It is not an accident that these countries have also successfully managed to enter into vaccine manufacturing. Other developing countries are not as well endowed, so developing a knowledge base in tandem with a comprehensive training system within a short period of time is not as easy.

Finally, staffing for an average facility in low-income country will often include local and several expatriate employees in order to entrench and safeguard the relevant technical skills. Expatriate staff, by their nature, require higher total compensation, which increases overall labour costs.

What options are available to developing countries?

The good thing is that the pace of technology and innovation now mean that production costs need not be a showstopper even for smaller, resource-poor countries. With small-scale, modular or disposable technologies, high-density bioreactors, and innovations in fill-and-finish processing it is possible for new entrants to successfully venture into vaccine manufacturing.

For low income countries, the proven route is starting with fill and finish capacity, and then through a phased approach, step up the value chain to manufacture antigens as well. This approach allows reduction of upfront investment risk while building manufacturing know-how in a controllable way.

As we mentioned earlier, not all vaccines are created equal. This also applies to building vaccine capacity. Biological-based production technologies (such as those for recombinant-protein or viral-vector vaccines) have higher capital and operational costs compared with novel mRNA-based vaccines, which can be easily and quickly synthesized in a chemical reactor. Further, mRNA-based processes will soon become even more accessible through mobile “RNA printers” that are promised to further reduce footprint, labour and cost commitments.

To negate the high up-front costs of purpose-built facilities, we recommend using modular and prefabricated facilities, which constructed off-site and delivered to the site where they will be put into use manufacturing. Prefabs have been used for many years in small molecule pharmaceuticals and offer benefits of fast delivery and capacity flexibility. They are now available for vaccine manufacturing, with delivery times of three to six months instead of 5 – 7 years.

An example of prefab solution is the one Exyte and Univercells Technologies have co-developed and is available for vaccines. Known as NevoLine, this system uses continuous/semi-continuous process equipment with automation, and a small manufacturing footprint which can be housed inside the ExyCell cleanroom. The facilities can be commissioned fairly quickly, typically within 3 months.

Finally, it is no secret that labour productivity is a major limitation in low income countries, but more so in many African countries. For these countries, productivity can be boosted through pool human resources and technology transfer from across the value chain – including from equipment and raw material vendors, to universities and NGOs. For instance, organisations such as WHO and PATH have platform which provide working pilot plant production processes (including all the SOPs, documentation and training), allowing new entrants to establish a robust production system fairly quickly while managing to reduce development costs and improve productivity.

So there we have it. Vaccine manufacturing is a capital-intensive endeavour. Short and long-run product costs are primarily driven by development and production-related costs, with facility maintenance, compliance with regulations, raw materials and labour being the most significant contributors. Countries seeking to localize vaccine supply need to invest heavily in facilities, equipment, skilled labour and ongoing quality management with a long time-horizon.

But investment in facilities, equipment and skilled labour is not enough. Having sound scientific knowhow is critical to vaccine production, so the issue of methodical transfer of knowhow, the possession of which provides the basis for long-term viability of the venture, becomes especially important. In this sense, technology transfer is one of the main ways ventures in low income countries can possibly acquire vaccine manufacturing capacity.

References

- Milstien J., Batson A., Meaney W. A systematic method for evaluating the potential viability of local vaccine producers. 1997;15:1358–1363. [PubMed] [Google Scholar]

- Robinson J.M. Vaccine production: main steps and considerations. In: Bloom B., Lambert P.H., editors. The vaccine book.2nd ed. Academic Press; San Diego: 2016. pp. 77–96. [Google Scholar]

- Gerson DF, Mukherjee B. Manufacturing process development for high-volume, low-cost vaccines. BioProcess International. April 2005.

- Gomez PL, Robinson JM, Rogalewicz JA. Vaccine Manufacturing. Vaccines, 6th ed. In: Plotkin S, Orenstien W, Offit P. Orlando, editors. WB Saunders Company; 2013. p. 44–57.

- Wilson P, Giving developing countries the best shot: an overview of vaccine access and R&D; 2010.

- WHO. WHO Prequalification Financing Model – Questions and Answers <http://www.who.int/medicines/news/prequal_finance_model_q-a/en/> [accessed 17.05.05].

- WHO. WHO updates on regulatory system strengthening and prequalification activities; 2016. <https:///www.unicef.org/supply/files/RSS_and_PQ__updates_vaccines-ID_c_rodriguez.pdf> [accessed 17.02.07].

- Sinclair A, Latham P. Vaccine production economics. In: Wen EP, Ellis R, Pujar NS, editors. Vaccine Manufacturing and Development; 2015. p. 415.

- Plotkin S, Robinson JM, Cunningham G, Iqbal R, Larsen S. The complexity and cost of vaccine manufacturing – An overview. Vaccine. 2017;35(33):4064-4071. doi:10.1016/j.vaccine.2017.06.003

The global chip shortage crisis is already being felt across many industries. While most of the news has focussed on the auto industry, industries ranging from medical devices to home appliances and consumer electronics are experiencing a crunch. In this article, we provide a status update on chip shortages and pharmaceutical equipment manufacturers.

The global chip shortage crisis is already being felt across many industries. While most of the news has focussed on the auto industry, industries ranging from medical devices to home appliances and consumer electronics are experiencing a crunch. In this article, we provide a status update on chip shortages and pharmaceutical equipment manufacturers. “Pharma equipment manufacturers are have reported no supply disruption”

“Pharma equipment manufacturers are have reported no supply disruption”