There is no shortage of market reports online that purport to estimate the global excipients market (currently estimated between 7.5 – 8.5 $ billion – 2021).

The question is how representative are these figures? Is the pharmaceutical flavour market really worth $400m?

We appraised 3 market reports, compared reported estimates with first hand primary data for specific products that we know very well.

The results are summarised in this post.

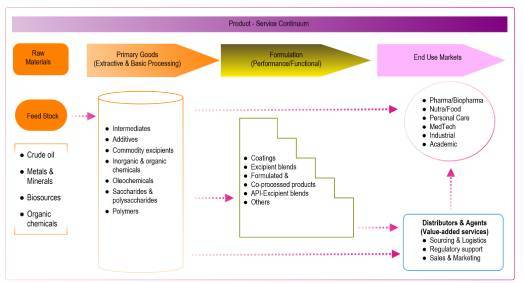

Excipients Value Chain

Excipients are specialty raw materials included in formulations of medicines, medical devices, some cosmetic products or nutraceutical food supplements. They are used to perform specific purposes, such as:

- stabilisation

- bulking

- aids to processing

As a sub-sector of the wider chemicals industry, the excipients sector plays an important role in the medicines value chain, making a real contribution to the world economy and human welfare.

Below is a simplified value chain:

You can read more about the excipients sector by downloading a Fact Sheet. about the global excipients sector through this link.

You can read more about the excipients sector by downloading a Fact Sheet. about the global excipients sector through this link.

End-users of Excipients

Excipients are utilised mainly in the manufacture of bio-pharmaceutical products, which accounts for the lion share of utilisation. However, other industries also use excipients, namely:

- Personal & Home Care

- Animal & Human Health

- Specialty Agriculture/Horticulture

- Topical & OEM Medical Devices

- Upstream applications (intermediates, fermentation, etc)

- Nutraceuticals/Dietary Supplements

- Industrial (e.g paper making, yes, paper making)

Comment

Over the years, we have found that market reports tend to ignore several excipient categories and materials, such as:

- starter materials and intermediates in other excipients.

- active pharmaceutical ingredient synthesis

- materials used in upstream biological manufacturing

- nutraceutical, medical devices and some food products

- industrial goods

Uptake into other sectors is also ignored. As an example, hyromellose and acacia can be used on their own or incorporated /co-processed into other excipients.

Leading Manufacturers

These are the top 10 excipient manufacturers (by product focus):

- Ashland

- BASF

- Cargill

- Colorcon

- Dow/Dupont/IFF

- Evonik

- JRS Pharma

- Roquette Freres

- ShinEtsu

- Tereos

Other companies that are significant but often missed out in analyses:

- Angus

- IOI Oleochemicals

- Cargill

- Ingredion

- Merck KGaA

- Samsung

- K+S Group

- CP Kelco

Comment

The failure by some researcher to companies such as Colorcon Inc. in the top tier of excipient manufacturers is a mistake.

This company commands a market share in excess of 80% for film coatings and has annual sales in excess of $800 million (both from sales of coatings & distribution

On the other hand, companies such as ADM and Lubrizol are always counted in – ADM may well be a large food ingredients producer – but their excipient portfolio are relatively small.

Sector Outlook

The three market reports we appraised (BCC Publishing, Markets & Markets, and Transparency Market Research) estimated the global excipients to be between $ 6.9 – 8.3 billion in 2021 rising to $ between $10.0 -10.7 billion.

The CAGR is quoted as being 5 – 5.8% for the study period (compare these to an earlier study period (2013-2018):

Markets & Markets and Transparency Market Research projected growth from $5.0 and $5.7 billion to 7.4 and 7.5 billion.

In terms of regional market share, we do not agree with their projections. Europe is pitched as the largest (approx. 32% share).

North America at 31%. Asia Pacific, including Japan, is estimated at 25%, while the rest of the world is put at 12 – 13%.

With respect to specific product or categories, the following are the estimated market sizes (2019 estimates):

- Microcrystalline cellulose: $300 million

- Povidone: $400 million

- Artificial sweeteners: $36 million

- Flavours: $400 million

- Film coatings: $800 million

Comment

We found a number of inconsistencies in projections the three market research companies presented.

First, the largest regional market is not Europe but North America. The excipient market closely tracks the wider pharmaceutical market, and currently, the North American region is the largest.

That said, there are some specific segments where Europe clearly leads, for instance, in inorganic salts and oxides, and sugars.

Secondly, when one takes a deep dive into particular products where we have very accurate results, the inconsistencies are even more glaring:

For instance, the total worldwide market for microcrystalline cellulose is $1billion (add $200 million if food use is included). China is the largest producer, closely followed by North America and finally, Europe.

The largest single producer is IFF (formerly, Dupont/FMC – Avicel®).

Other discrepancies, based on primary market data (actual producer data) are shown below (in 2021):

Thirdly, market researchers ignore an up-and-coming product category, which is elastomers, rubbers and silicones, which are increasingly used in transdermal drug delivery and topical medical devices.

Fourthly, there are further inconsistencies with respect to country data for individual product market size.

A case in point is that the total flavour market (it is just not possible to put this at $400m), we would say it is more like $100 million – and possibly half that (50 – 70 million, at best).

We established that generally, market research companies underestimate the total excipient market by around 15%. The more accurate figure should be in the region of $9 to 10 billion in 2021.

Market Drivers

The major growth drivers are rightly identified as growth in demand for drugs across the world, which drives the demand for functional materials.

All the three reports identify growing demand for co-processed, full-formulated excipient systems and technologies that enhance patient convenience, such as orally disintegrating products, film coatings and modified release.

The role of biologicals, which have consistently accounted for up to 40% of new drug approvals, is mentioned, as are patent expirations and entry of generics. Both factors create new markets for raw materials.

Biological products have been the fastest growing segment for the last two decades, and this trend shows no signs of slowing down.

Market constraints are identified as increasing regulations, a rise in pharmaceutical product R&D costs, a lack of innovation and increasing requirement for supply chain transparency.

The long development cycles and high attrition rates, and particularly, very costly late-stage failures that are emblematic of pharmaceutical R&D, are major dampeners of excipient market growth. It takes on average 4 years, from the point a pharmaceutical company takes a sample for assessment, to make a commercial sale for an excipient!

A lack of innovation is also rightly identified. Innovation is what traditionally drives market growth, and with nearly two decades since the last brand new excipient was introduced, it is not difficult to see why growth in the sector has remained lacklustre for a while.

Comment

While it is the case that the sector has increasingly demanded supply chain transparency, the reasons were not due to outsourcing to low cost countries, but rather, the Falsified Medicines Directive.

We think that the contribution of biologicals to market growth is over played. This is because biologicals generally require relatively simple salts (buffers, and occasionally, cryoprotectants) to formulate, meaning that, from an excipient perfective, they are not significant.

Finally, the role of IPEC and EXCiPACT GMP to market growth is also over played in the analyses since, as per current regulations, GMPs are not mandatory for excipients.

Final thoughts

In our judgement, the current excipient market size of between 7.5 – 8.5 $ billion (2021) underestimates the size of sector by 15%, and the true figure should be between $9.5 and 10.5 billion.

We have also identified a number of omissions and errors in presented figures for individual products and country data, which do not tally with primary market information from excipient manufacturers (for example, MCC, silica, flavours, povidone, sugars and film coatings).

In our judgement, BCC Research excels in their strategic assessments, and their total market estimates also tended to be more in line with primary data that we have access to.

On the other hand, Transparency Research had more accurate data on regional market-shares, data on film coatings as well as xxx. However, data on specific product categories were less accurate.

Disclaimer

The information in this post idoes not constitute any offer, recommendation or solicitation to any person to enter into any transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future value.

Pharmacentral is not an investment adviser, and is not purporting to provide you with investment, legal or tax advice. We accept no liability and will not be liable for any loss or damage arising directly or indirectly from your use of this information

You should seek your own advice regarding the appropriateness of investing in any securities, financial instruments or investment strategies referred to on this post.

Statements regarding future prospects may not be realised.